What to Do With a Windfall of $200k

- Carolyn Stanton

- Jul 21

- 3 min read

Updated: Jul 22

A $200,000 windfall can come from a variety of sources, both expected and unexpected. Often it’s from an inheritance - receiving money from a deceased relative’s estate, or from the sale of property.

In other instances you could receive $200k from selling your business, a gambling win, a legal settlement or a bonus or severance package from your employer. In the event that any of these ‘gifts’ are bestowed onto you, you owe it to yourself to structure the windfall so that the interest is the gift that keeps on giving.

Here’s a few of our top suggestions from the Wealth Elf team to optimize this situation, and check out our guide for a windfall of $50,000.

First before you do anything, park the funds in a high-yield savings or money market account while you plan. Typically online banks offer the most bang for your bank as traditional retail banks will only provide pennies in interest.

Some banks with attractive HYSA rates are: BrioDirect (5.35%), My Banking Direct (5.55%) and Jenius Bank (5.25%). Note each institution will have varying minimum deposits and you won’t be able to walk into a location to pull it out, you’ll have to facilitate an online transfer.

You’ll be able to receive the monies via check several days later or through a wire transfer to another brick and mortar bank.

Next, evaluate your financial picture both long and short term looking at your debts, goals, income, taxes, etc.

Your first order of operation should be to pay off credit cards or loans with interest rates above ~6–7%.

The one exception worth considering in this instance is your mortgage. If you’ve put down more than 20%, have avoided PMI insurance, and have an attractive mortgage rate, it may make sense to just leave that debt alone. The rationale is you could make a higher percentage return in real estate or through investments.

After that’s complete, ensure 6 months of Emergency funds are locked away. This should cover the monthly total of your mortgage or rent, car payments, insurance and food. With more and more companies proceeding with M&A’s, pivoting towards layoffs, or increasing their use of AI - you’ll want to keep resources in a liquid, safe place (like a HYSA or money market account).

Now for the fun part, investing for your future. Wealth Elf recommends a balance of real estate and index funds or ETF’s for long term growth. If you’re looking for investments you can put on autopilot check out our guide: Best Long Term Investments To Put on Autopilot.

Use a tax-advantaged account if eligible (Roth IRA, Traditional IRA, 401(k)).

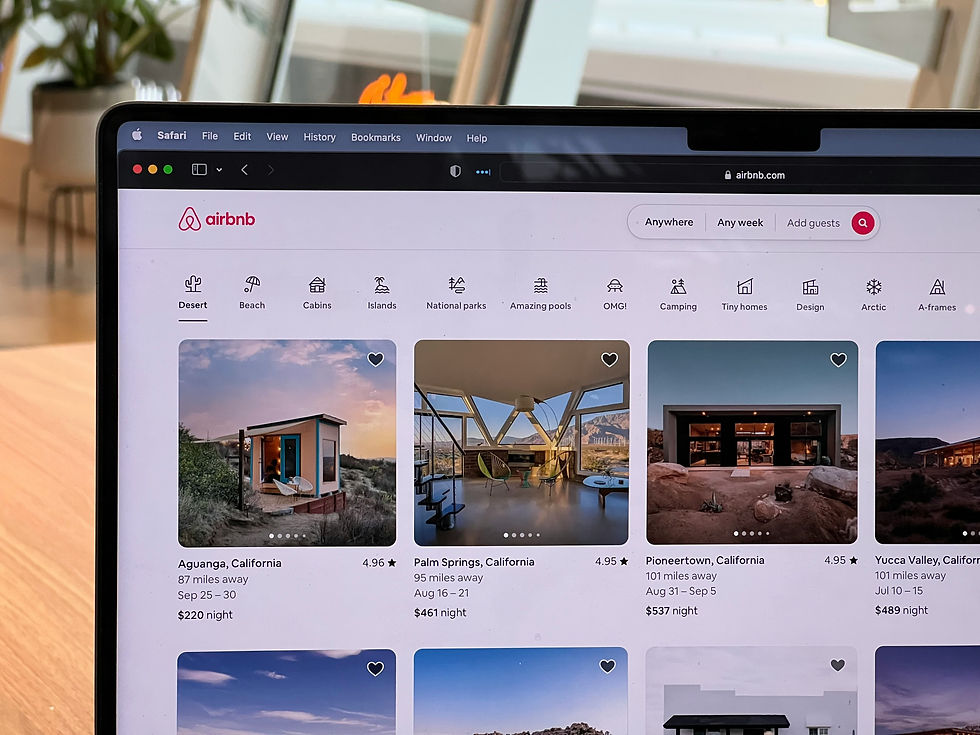

Additionally you can consider money towards a second home to use as an investment property facilitating rental income while it appreciates over time. The facts are the facts - the planet is not making any more land. Look for a property in an area with a steady job economy or attractive for short term stays like a vacation rental.

If that feels like too much of an undertaking (second mortgage or borrowing against the equity of your home) you can pivot to REITS otherwise known as real estate investment trusts for passive exposure instead.

Consider something like $140,000 in ETF’s (ie: VTI, S&P 500) then $60,000 towards Real Estate. If you’re serious about buying a property just adjust for closing costs.

Of importance, get your tax strategy into effect. Check whether your windfall is taxable (e.g., from inheritance, bonus, or legal settlement) and consider consulting a CPA or financial advisor to plan for Capital gains, Estate taxes and Strategic donations (for tax deductions).

Last, consider investing into small businesses to flex your creative muscles but only if you’re willing to accept a great deal of risk.

For any opportunities brought your way looking for seed funding only proceed if the business plan is rock solid and guarantees 10%+ in returns. Also we like an ironclad legal agreement.

Anything we forgot? Let us know at @Wealth_Elf.

Comments